Click right link below to read the first three chapters

of TAP YOUR A$$ETS. Click left link to preorder book.

of TAP YOUR A$$ETS. Click left link to preorder book.

| |||

|

COMING SPRING 2024

Scroll down to see (1) a YouTube video about how to become financially free with just one rental house (2) data that compares the profitability of rental real estate to stocks, (3) the introduction and first two chapters of the book, (4) a YouTube video about why rental real estate crushes stocks, and (5) a discussion about real estate between Ken McElroy and me about the real estate investing book I ghostwrote for him. |

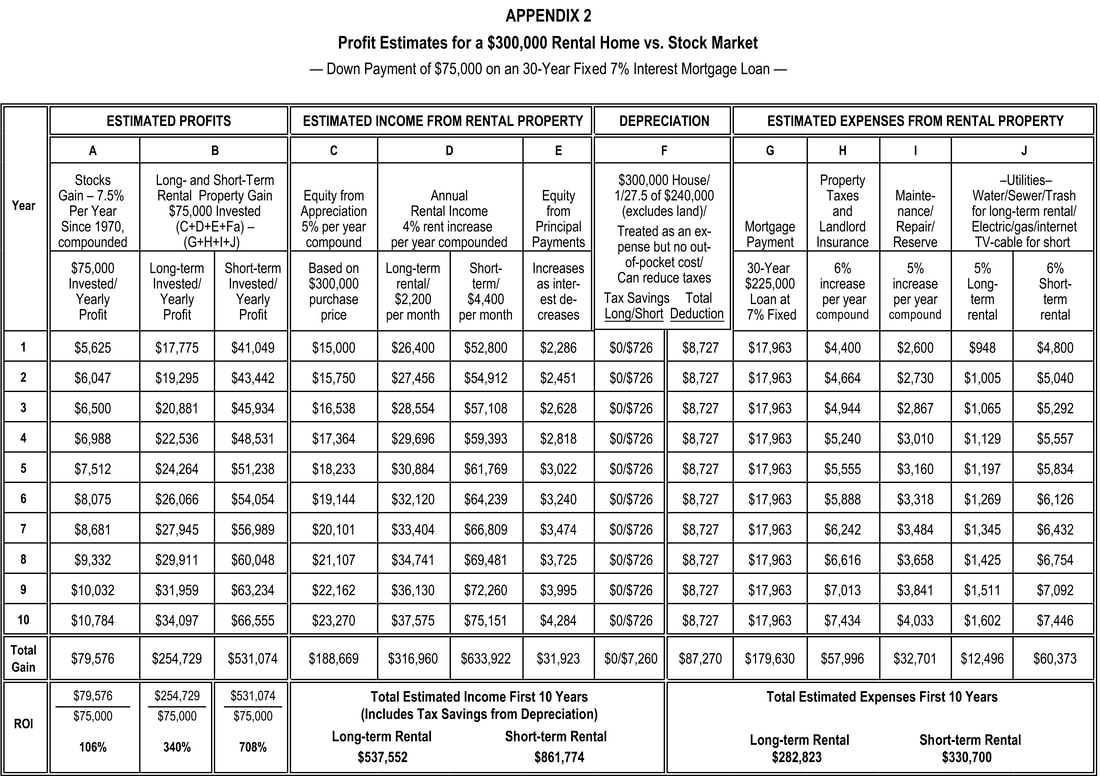

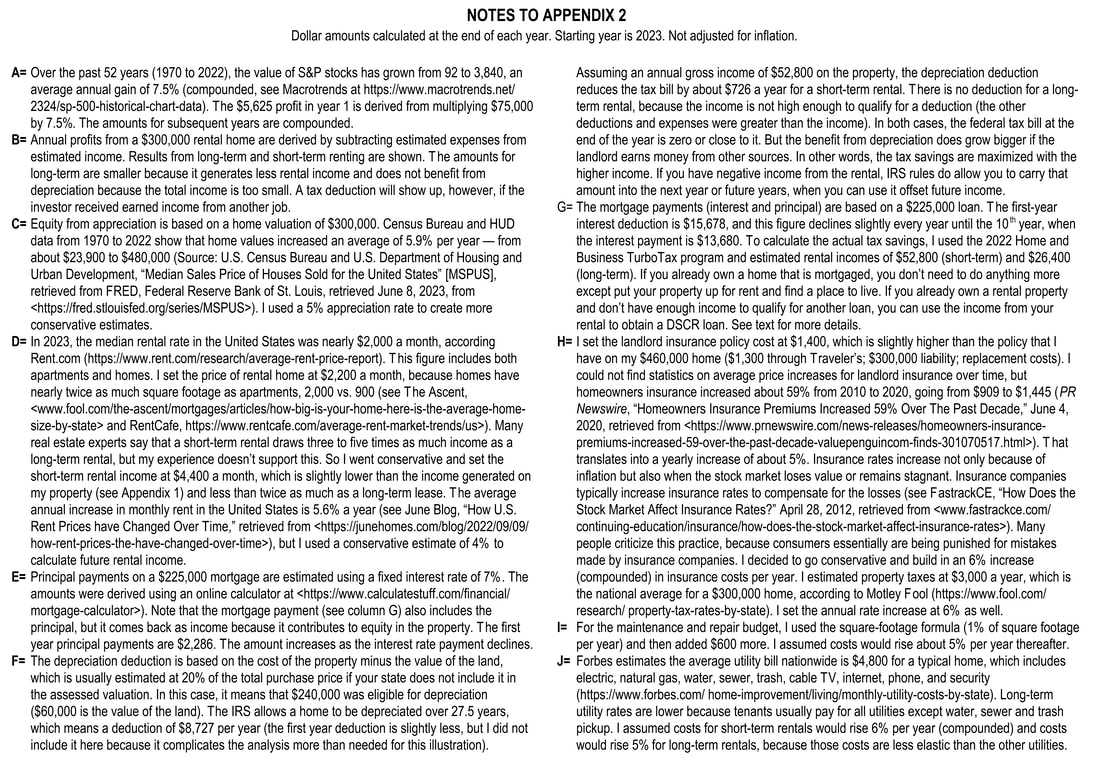

Rental Homes Crush Stock Returns

New Book Uses 50 Years of Data to Make Profit Predictions This story is also posted at CREUniversity.com A typical rental home in the United States generates three to six times more profits than an investment in the S&P 500 Index fund, according to a long-term statistical analysis conducted by a social scientist-turned-real-estate consultant. “One of the biggest myths in the investing community is that stocks outperform rental properties and homes,” said Dr. David Demers, a retired Washington Stat (click here to finish reading the story) |