COMING MAY 1, 2024

|

|

|

A Note from Dr. Dave (excerpt from Tap Your A$$ETS)

I am not a real estate mogul, nor do I aspire to be one.

I purchased my first rental property when I was 65 (if I can do it, you can, too).

I’m a real estate investor with modest dreams — to maintain my financial independence in old age. Financial freedom doesn’t necessarily mean great wealth. Rather, it’s a state of mind where you never worry about the paying the next bill.

The advice I give in this book can’t make you wealthy overnight. But you can achieve financial independence in as little as a year or two, and you can generate more than $1 million in profits in 10 to 20 years with just one modest rental property (faster with two or a higher-priced property).

Skeptical?

I hope so.

That’s the first sign of a wise investor.

The second sign is courage.

If you are the type of person who always plays it safe, you likely will not make a good investor. Risk is an element of all entrepreneurial ventures.

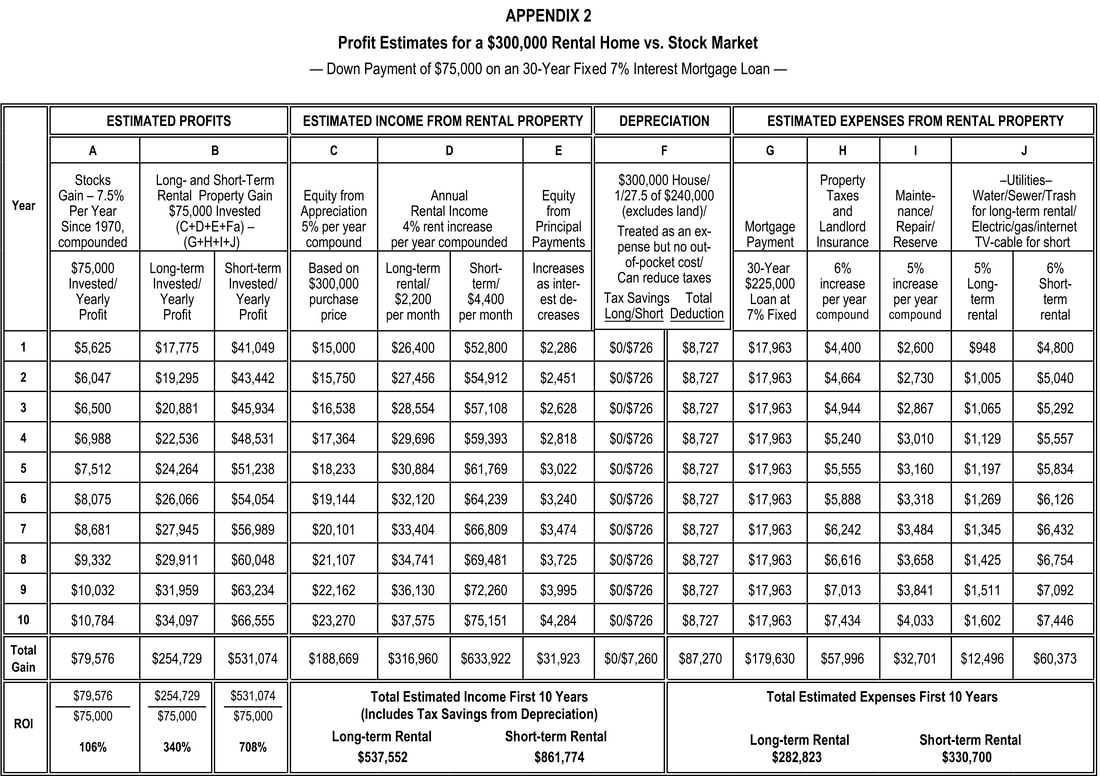

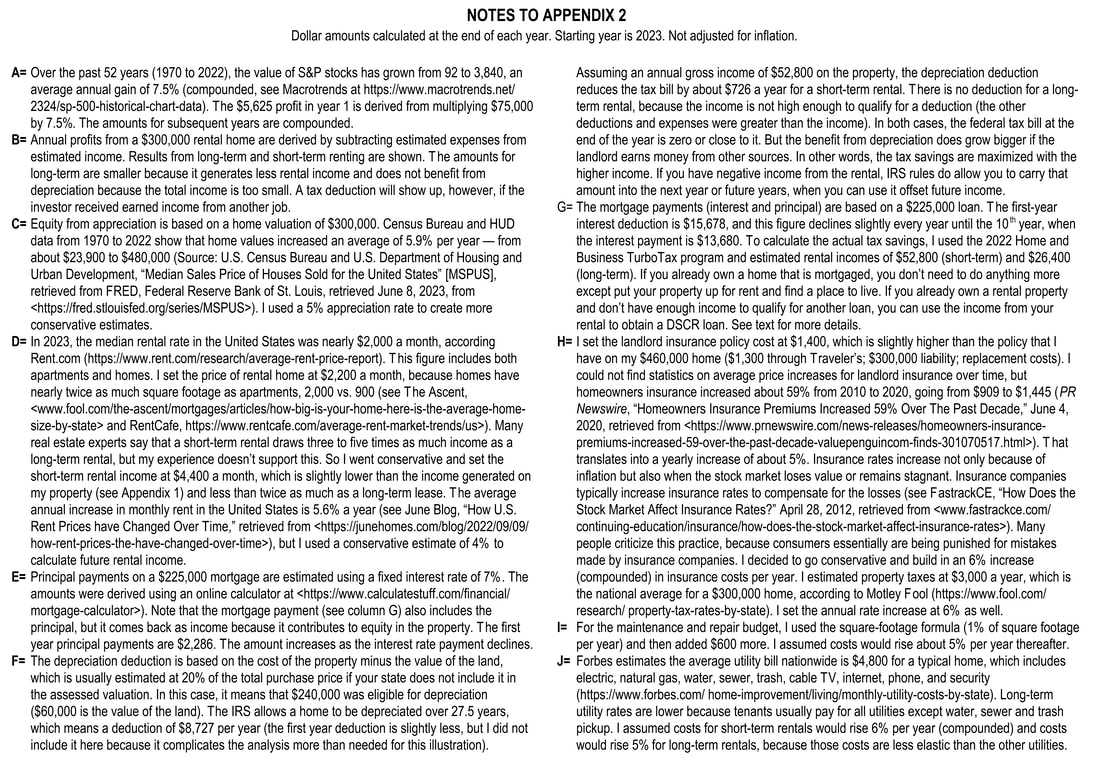

But investing in rental real estate is far less risky than the stock market and far more profitable. In fact, the average mortgaged short-term rental home in the United States produces six times more profits than the stock market, and a long-term rental produces three times more. And since 1950, the stock market has lost 20 percent or more of its value a dozen times, compared to only once for housing values.

A third sign that you are a good candidate to be an active real estate investor is a willingness to roll up your sleeves and do a little work. Passive investments like the stock market require little effort. Executives who sit at desks all day love the stock market (at least when its value is going up).

A rental property requires a little more of your time. But I spend no more than 15 hours a week (often less) on both of my rental properties. The biggest part of my job is cleaning between guests at my short-term rental home. Of course, you can hire someone to do that, but when you do it yourself, you know it’ll be done right, and there are big rewards for doing that. As of this writing, all 56 of the reviews I’ve received from Airbnb guests are 5 star.

For my efforts, I estimate that I earn about $62 an hour. If I were working full time, I would be earning a annual salary of $124,800. But unlike salaried workers, I pay little or no federal income tax on my rental income, and so I save about $30,000 in taxes (federal income tax, social security, Medicaid and Medicare), which means I actually earn about $74 an hour.

There are several good nonfinancial reasons why real estate is such a great investment. First, you don’t have to quit your regular job. You can work on your property at other times during the day or on the weekends. Second, you don’t need a college education or a real estate license. It’s not rocket science and you can learn as you go and through talking with other landlords, real estate agents and friends. Third, you don’t need a lot of money to invest, especially if you are a first-time home buyer. Several government-backed programs allow you to buy a home for less than 10 percent down. VA even has a no down-payment program.

If you can’t afford the down payment, there are other options, and I explore them in Part III of this book. You can find partners or investors, including friends or family members. You might not even have to put any money down.

The purpose of this book is to help you obtain your first rental house or convert your current home into one and achieve financial freedom. It’s not as difficult as you might think.

If you already own a property, whether it’s mortgaged or not, you’re job is easy. All you need to do is find other living arrangements for at least six months. You can stay with a friend or family member, or, if you have the resources, rent a cheaper place. After that, you can use the income on your rental property to obtain another mortgage, such as a DSCR loan, to purchase another home for yourself or another rental. That’s what I did.

If you don’t own a property but have a steady income, a fair credit rating and not too much debt, you likely can qualify for a conventional mortgage loan or even a low-interest, low-down-payment mortgage loan through the Federal Housing Administration (FHA), the Veteran’s Administration (VA), or other government backed loan programs. Most require you to live in the house for at least a year, but after that you can rent it out.

Or you can forego real estate investing altogether and spend the rest of your life working for someone else. (Okay, maybe that isn’t as bad as I just implied.)

Either way, it can’t hurt to learn more about investing in rental properties, even if you don’t buy one. This knowledge can help you make better decisions when you buy a home for personal use as well.

So I hope you’ll join me in this learning process, and, please, don’t hesitate to contact me through my website (DrDavidDemers.com) or email ([email protected]). I will respond to your messages.

Note: Footnotes have been excluded from this excerpt.

I am not a real estate mogul, nor do I aspire to be one.

I purchased my first rental property when I was 65 (if I can do it, you can, too).

I’m a real estate investor with modest dreams — to maintain my financial independence in old age. Financial freedom doesn’t necessarily mean great wealth. Rather, it’s a state of mind where you never worry about the paying the next bill.

The advice I give in this book can’t make you wealthy overnight. But you can achieve financial independence in as little as a year or two, and you can generate more than $1 million in profits in 10 to 20 years with just one modest rental property (faster with two or a higher-priced property).

Skeptical?

I hope so.

That’s the first sign of a wise investor.

The second sign is courage.

If you are the type of person who always plays it safe, you likely will not make a good investor. Risk is an element of all entrepreneurial ventures.

But investing in rental real estate is far less risky than the stock market and far more profitable. In fact, the average mortgaged short-term rental home in the United States produces six times more profits than the stock market, and a long-term rental produces three times more. And since 1950, the stock market has lost 20 percent or more of its value a dozen times, compared to only once for housing values.

A third sign that you are a good candidate to be an active real estate investor is a willingness to roll up your sleeves and do a little work. Passive investments like the stock market require little effort. Executives who sit at desks all day love the stock market (at least when its value is going up).

A rental property requires a little more of your time. But I spend no more than 15 hours a week (often less) on both of my rental properties. The biggest part of my job is cleaning between guests at my short-term rental home. Of course, you can hire someone to do that, but when you do it yourself, you know it’ll be done right, and there are big rewards for doing that. As of this writing, all 56 of the reviews I’ve received from Airbnb guests are 5 star.

For my efforts, I estimate that I earn about $62 an hour. If I were working full time, I would be earning a annual salary of $124,800. But unlike salaried workers, I pay little or no federal income tax on my rental income, and so I save about $30,000 in taxes (federal income tax, social security, Medicaid and Medicare), which means I actually earn about $74 an hour.

There are several good nonfinancial reasons why real estate is such a great investment. First, you don’t have to quit your regular job. You can work on your property at other times during the day or on the weekends. Second, you don’t need a college education or a real estate license. It’s not rocket science and you can learn as you go and through talking with other landlords, real estate agents and friends. Third, you don’t need a lot of money to invest, especially if you are a first-time home buyer. Several government-backed programs allow you to buy a home for less than 10 percent down. VA even has a no down-payment program.

If you can’t afford the down payment, there are other options, and I explore them in Part III of this book. You can find partners or investors, including friends or family members. You might not even have to put any money down.

The purpose of this book is to help you obtain your first rental house or convert your current home into one and achieve financial freedom. It’s not as difficult as you might think.

If you already own a property, whether it’s mortgaged or not, you’re job is easy. All you need to do is find other living arrangements for at least six months. You can stay with a friend or family member, or, if you have the resources, rent a cheaper place. After that, you can use the income on your rental property to obtain another mortgage, such as a DSCR loan, to purchase another home for yourself or another rental. That’s what I did.

If you don’t own a property but have a steady income, a fair credit rating and not too much debt, you likely can qualify for a conventional mortgage loan or even a low-interest, low-down-payment mortgage loan through the Federal Housing Administration (FHA), the Veteran’s Administration (VA), or other government backed loan programs. Most require you to live in the house for at least a year, but after that you can rent it out.

Or you can forego real estate investing altogether and spend the rest of your life working for someone else. (Okay, maybe that isn’t as bad as I just implied.)

Either way, it can’t hurt to learn more about investing in rental properties, even if you don’t buy one. This knowledge can help you make better decisions when you buy a home for personal use as well.

So I hope you’ll join me in this learning process, and, please, don’t hesitate to contact me through my website (DrDavidDemers.com) or email ([email protected]). I will respond to your messages.

Note: Footnotes have been excluded from this excerpt.